Blogs

In this example, the maximum completely covered harmony for this package are $714,285. The many other participants’ shares of one’s deposit are less than $250,one hundred thousand. Because the his share away from Account 1 ($350,000) try lower than $five hundred,one hundred thousand, he is fully insured. FDIC regulations do not limit the amount of beneficiaries you to a good trust owner identifies due to their estate thought intentions. Generally speaking, per holder out of a believe Account(s) is actually insured around $250,one hundred thousand for each and every unique (different) qualified beneficiary, as much as all in all, $step 1,250,100 for five or more beneficiaries. To own Trust Membership, the phrase “owner” also means the new grantor, settlor, otherwise trustor of one’s believe.

Tricks for To try out at the $step one Minimal Put Gambling enterprises – instadebit casino online

The Covered Places try an intensive malfunction out of FDIC put insurance rates exposure for well-known account possession groups. Even if you not have lost currency resting inside a missing family savings, then chances are you are standing on some money that you may money in today. It currency originates from financing used in banking institutions, creditors otherwise firms that haven’t got contact with the owner for over per year and have already been turned over for the state. The new FDIC merely ensures your bank account when it is inside a put account in the a keen FDIC-insured bank. Customers’ places remain safe during these banking institutions, because the does consumer use of their cash.

Misplaced deposits: Destroyed from the Anticipation: Expertise Misplaced Places

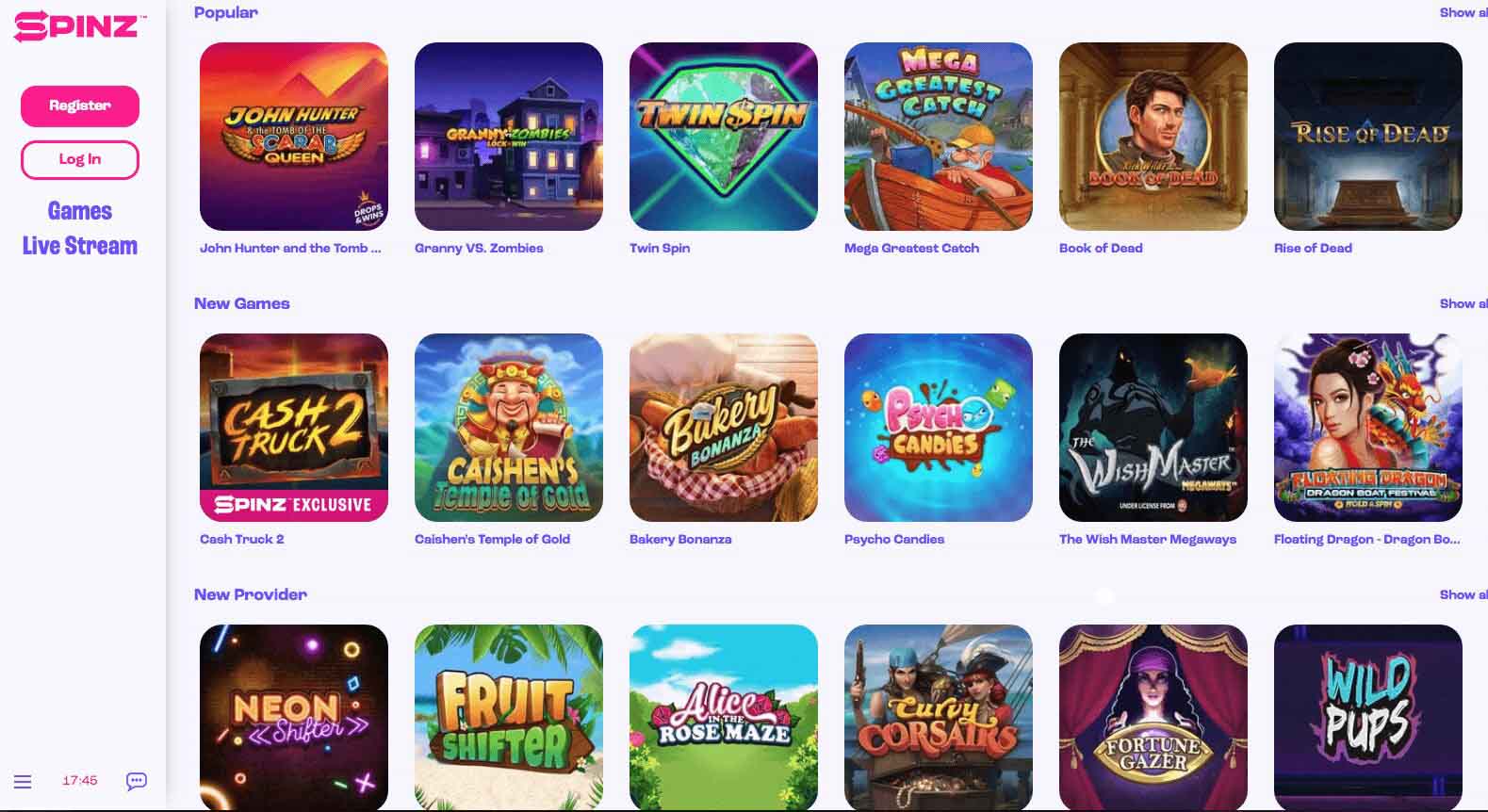

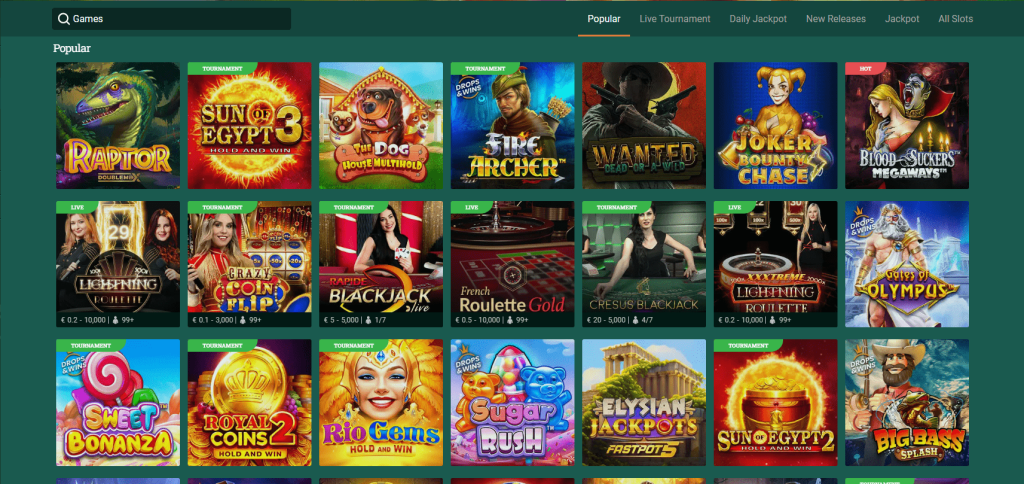

Take a look at all of our set of required step 1$ deposit casino websites to have online casinos that provide your 100 percent free spins for just 1 dollar. Sure, extremely $step 1 put casinos within the Canada offer you a no cost revolves bonus. ✅ Free spins and deposit fits incentives on your 2nd four places We made in initial deposit because of the look at / bucks and acquired an acknowledgment, nevertheless the lender claims you to definitely their facts don’t mirror the fresh put. The corporation, connection, or unincorporated organization need to be separately organized less than county legislation and you can perform mostly for many mission other than to improve put insurance rates visibility. FDIC insurance rates discusses traditional deposit accounts, and you may depositors need not sign up for FDIC insurance coverage.

These may is reload incentives, cashback offers, totally free spins, and VIP benefits instadebit casino online . They can were totally free revolves, deposit matches, if any-deposit incentives. Check out our casino better desk to find the best casinos on the internet.

No deposit casino bonuses give you free extra fund or spins for only enrolling, which makes them best for research the fresh casinos or games chance-totally free. No-deposit incentives are totally free casino now offers that permit your play and earn a real income as opposed to spending your own dollars. So, when you are any casino bonus can turn a return, try to make deposits making use of your own money and set actual bets in order to victory real money.

FDIC deposit insurance policies discusses the bill of each and every depositor’s account, dollar-for-money, to the insurance coverage restriction, as well as dominant and you will one accrued attention from the date of one’s insured bank’s closing. The fresh FDIC’s info signify you have not yet , said your deposit insurance policies view, from the cashing the new consider otherwise because of the depositing they on the an account in the a good depository organization. And then make a 1 dollar put will get your a plus and the possible opportunity to begin to play real cash games whatsoever the needed gambling enterprises. You could potentially cash out around half a dozen times your own brand new put just before checking out the additional bonuses.

Use these fee procedures

Be assured, our required $step one casino bonuses are typical for you personally within the Canada. You may also claim a lot more deposit incentives after that $step 1 added bonus the place you’ll score totally free spins and you may BTC. Remark the put membership arrangement for your bank’s counterbalance coverage. All the details less than temporarily refers to different put things given, the new FDIC control kinds and their appropriate insurance policies restriction. Cellular look at put try an instant, much easier means to fix deposit fund with your smart phone. However, you could potentially posting money to help you family and friends as a result of cellular banking without using a by using digital commission services for example Zelle®.

Men need not end up being a good You.S. resident otherwise citizen for their places insured from the the fresh FDIC. The internet type of that it pamphlet would be up-to-date instantly in the event the signal transform affecting FDIC insurance rates are created. While the my money try transferred to your other people membership, I wonder just what my receipt would’ve look like thereon day. A deposit are credited on my bank account in error.

To help you qualify for it extended publicity, what’s needed to possess insurance coverage inside for every control classification must be came across. A flexible Order out of Withdrawal (NOW) membership is actually a savings deposit–perhaps not a demand deposit account. It personnel work for plan’s $700,000 deposit try totally covered. Even though arrangements qualify for solution-due to visibility, insurance rates can’t be calculated by multiplying the number of professionals because of the $250,100000 while the package people frequently have various other welfare from the bundle. An employee Benefit Package account is in initial deposit of a pension plan, defined benefit bundle, or other personnel benefit plan that is not thinking-brought. Since the Lisa have titled about three qualified beneficiaries anywhere between Accounts step 1 and you can dos, their restrict insurance rates is actually $750,100000 ($250,one hundred thousand x step 3 beneficiaries).

Editor’s Choices: SlotoCash Gambling enterprise

Following statutory 18 week months provides expired, in order to comply with government laws, the new FDIC sooner or later transfers child custody of these financing to your County otherwise Area of the depositor’s history recognized target and therefore exhibited on the the fresh were not successful institution’s info. FDIC sent characters on the last understood target because searched inside bank facts and you can FDIC does not have any listing of any states getting created for your own put. If the something try unclear, the guy associations the newest gambling establishment.

What happens to my insurance coverage easily has dumps at the a few covered banking institutions you to definitely mix? To choose insurance to have faith profile, the newest FDIC basic determines the degree of the brand new believe’s dumps belonging to for each owner. The newest FDIC will bring separate insurance policies to have a depositor’s fund in one insured financial, should your deposits take place in various possession classes. A trust owner can also be identify as many beneficiaries as they such as; but not, to have put insurance policies motives, a believe account proprietor you to definitely means four or even more qualified beneficiaries will not be covered beyond $1,250,100 for every financial. Of varying sizes banking companies across the country render put accounts recognized by FDIC deposit insurance rates.

► Forgotten and you can Forgotten Safe-deposit Packages Annually a large number of bank safe-deposit boxes is forgotten otherwise given up from the owners and heirs. That is true even if a or money purchase specifies an excellent ‘void-after’ go out. Will you be owed forgotten money during the a bank one to closed otherwise changed label? Do to their long lasting characteristics, more and more people and you may heirs – whom may not be alert to a dead cherished one’s IRA or rollover 401k – are not able to claim membership to which he or she is entitled. A government audit of 21 biggest insurance businesses found they did not pay death advantages to beneficiaries if they knew the fresh covered is actually deceased. The newest account might have been closed in years past, however if it wasn’t, there are still the lost membership in the lender, to the FDIC, otherwise for the condition.